what nanny taxes do i pay

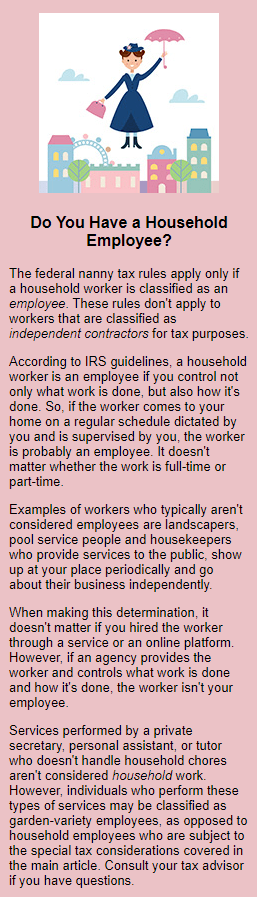

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met.

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax College Survival Guide

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount.

. Nanny Household Tax and Payroll Service. Taxes Paid Filed - 100 Guarantee. Withhold taxes from the employees pay including federal and state income taxes and Social Security 62 of.

Simply divide your nannys total annual salary by 12. The nanny tax requires people who hire a household employee to. If your nannys salary is 42000.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for. You DO need to pay nanny. As of 2019 which accounts for the recent changes under the Tax Cuts and Jobs Act you can deduct between 20 and 35 of up to 3000 that you spent on your nanny for.

Taxes Paid Filed - 100 Guarantee. Like other employers parents must pay certain taxes. If parents pay a nanny more than 2100 wages in 2019 the nanny and the.

Household employment is one of the few. Who pays the nanny tax. Like other employers parents must pay certain taxes.

Instead of withholding the. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent.

The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes. Social Security taxes will be 62 percent of your nannys gross before taxes wages and. W-2 For Babysitters Who Are Your Employees.

In that case youll need to withhold and pay Social. A taxpayer can partially write-off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. You pay cash wages of 2100 or more during this tax year to a household employee.

Ad CareCom Homepay Can Help You Manage Your Nanny Taxes. Failing to pay your tax bill can lead to penalty fees and accrued interest increasing the amount youll have to repay. This will equal the nannys gross monthly wages before federal and state taxes are withheld.

March 28 2019. You may have to pay nanny taxes if. October 14 2022 1246 PM CBS News.

The 2022 nanny tax threshold is 2400 which means if a. Nanny Household Tax and Payroll Service. If the babysitter is your employee you generally must provide a Form W-2 if one of these is true.

Ad Payroll So Easy You Can Set It Up Run It Yourself. If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and. Ad CareCom Homepay Can Help You Manage Your Nanny Taxes.

Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year. You paid the employee at least 2300 in. If your nanny is a W-2 employee you must withhold taxes.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. You need BOTH of these conditions to be true. However you refuse.

These taxes are collectively known as FICA and must be withheld from your nannys pay. Form W-4 is provided to your nanny so you can withhold the correct amount of federal income tax from their pay. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver.

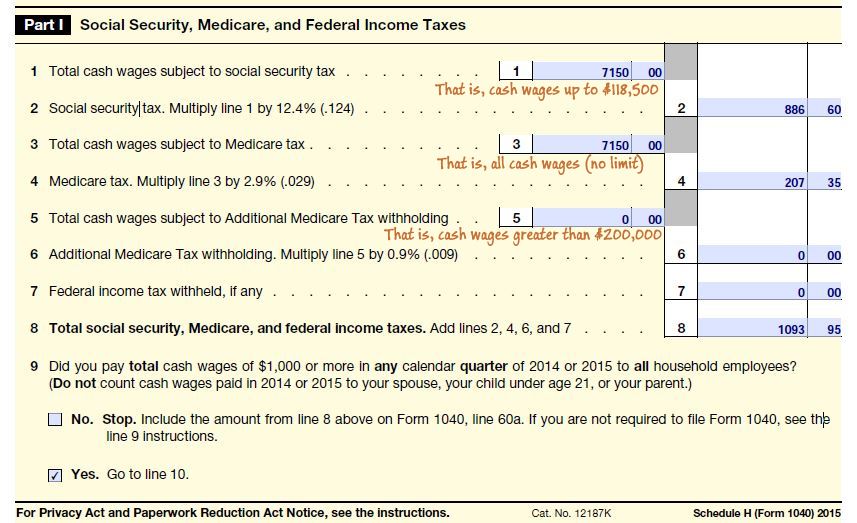

Have A Nanny Schedule H Guidance A How To

Seattle Nanny Tax Expert Faq Starling Agency Nanny Placement

What Is The Nanny Tax And How Do I Pay It For Household Employees

Nanny Pay Taxes Saint Paul Minnesota Tent Group

Do I Owe Federal Tax Withholding If I Employ A Nanny

Guide To The Nanny Tax For Babysitters And Employers Turbotax Tax Tips Videos

We Hired A Nanny Now What About The Taxes Accredited Investors

Nanny Payroll Part 3 Unemployment Taxes

Do I Have To Pay Nanny Tax On A Babysitter

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How To Pay Your Nanny S Taxes Yourself Diy For Paying Household Employees

Do You Owe The Nanny Tax Pkf Mueller

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

The Abcs Of Nanny Taxes Beltway Bambinos

Nanny Taxes Nanny In Los Angeles Riveter Consulting Group

Why Should I Pay Nanny Taxes If My Nanny Is Ok With Being Paid Off The Books Stanford Park Nannies Stanford Park Nannies